Following the conclusion of the Federal Reserve’s two-day policy meeting, the following are the key takeaways:

Interest rates don’t change:

The Federal Reserve made the largely expected decision to maintain its benchmark interest rate. This year’s range, which was established last year, is 5.25% to 5.5%.

In an effort to reduce excessive inflation, there had been eleven rate rises prior to this decision.

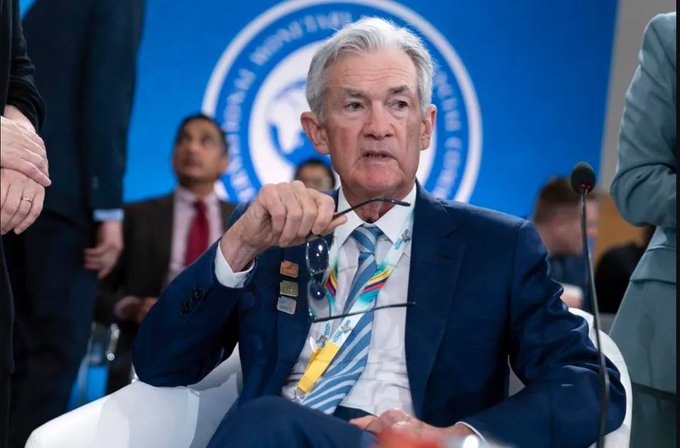

Fed Chair Jerome Powell underlined the need of maintaining stability while keeping a careful eye on economic data.

Expectations for Rate Cuts and Inflation:

One major worry has been inflation. Recent data, however, indicates that the Fed is getting closer to its 2% inflation objective.

The president of the Chicago Fed, Austan Goolsbee, called the most recent inflation statistics “excellent.”

If inflation stays low, Fed Governor Adriana Kugler made a suggestion that a rate reduction would be justified “later this year.”

Although the Fed didn’t specifically announce a rate decrease this time, there is rising optimism that it will occur shortly.

Revision of the Statement Language:

The terminology used in Fed statements is changing. It’s probable that decision-makers will recognize the advancements in inflation.

This acknowledgement paves the way for further fee reductions.

The general positive inflation prognosis can be attributed in part to the moderation of housing costs.

Powell’s News Conference:

The news briefing by Fed Chair Jerome Powell was when the actual pyrotechnics happened.

Powell was questioned over the direction of monetary policy. Analysts were excited to see anything fresh.

The main question became whether Powell will follow his most recent screenplay or provide anything new.

Gazing Forward:

Markets and economists are watching closely to see if the committee announces a rate reduction in September.

If the Fed does decide to lower interest rates, this might be the start of a string of changes.

Powell’s remarks at the news conference will have a significant impact on how the market anticipates events.

In conclusion, even if the Fed kept interest rates within their present range, underlying dynamics point to a potential rate drop in the near future. Keep a look out for more hints at upcoming meetings!

Jerome Powell (Fed Chair):

— Kevin Svenson (@KevinSvenson_) July 31, 2024

– "A reduction in our policy rate could be on the table as soon as the next meeting in September."#FederalReserve #FOMC #Video pic.twitter.com/ICCnljanQP