The renewable energy solutions business Sahaj Solar has gained attention for its first public offering.

2.92 million new shares will be issued as part of the IPO in an effort to raise ₹52.56 crore 1.

Given the company’s experience with solar solutions and dedication to sustainability, investors are closely following this initial public offering.

Strong Investor Interest

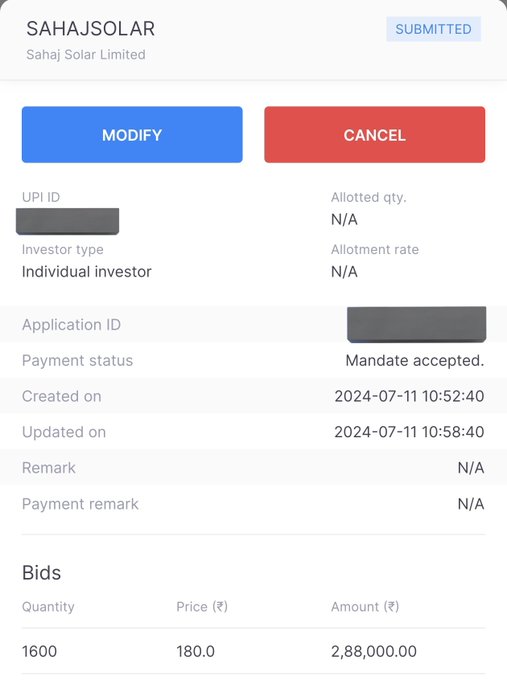

There was a great deal of interest for the Sahaj Solar IPO on the first day of bidding, July 11.

37.60 times as many participants subscribed, demonstrating strong investor confidence.

The majority of the oversubscription was made by retail investors, who exceeded their quota by an astounding 65 times.

Qualified institutional buyers (QIBs) subscribed 49.8 times more than their share, demonstrating their strong interest as well.

Overview of Finances

In addition to producing PV modules, Sahaj Solar also sells solar water pumping systems and EPCI services.

The company’s net profit for the fiscal year 2024 increased to ₹13.16 crore, more than twice as much as the previous year’s ₹6.35 crore.

Over the same time frame, operating revenue climbed to ₹201.2 crore.

SME IPO : SAHAJ SOLAR LIMITED

— Aftertrade Broking (@AfterTradebro) July 11, 2024

DAY 1 | Subscription Details

Total : 37.60x pic.twitter.com/MyM3qTbfCY

Making Use of Proceeds

Working capital needs will be the main use for the net proceeds from the new issuance.

The money will also be used for general business reasons, which will guarantee the company’s upward trajectory.

Participation in Anchor Books

Three investors took part in the anchor book prior to the IPO:

CCV Emerging Opportunities Funds-I Varsu India Growth Story Scheme 1 Persistent Growth Fund

PCC-Cell 1 of Acintyo Investment Fund

They made ₹14.83 crore in total investments in Sahaj Solar.

An encouraging step toward a brighter future is Sahaj Solar’s initial public offering (IPO). The company’s path develops as investors demonstrate their support for green energy. ☀️🌱

Applied for Ganesh Green Bharat Limited SME

— Mayur Kasale🇮🇳 (@mayurkasale) July 9, 2024

HDFC Bank Makes as anchor ⚓ investor its almost a mainboard kind of anchor book.

The next is Sahaj Solar 👍 pic.twitter.com/LTNNYiGlYs