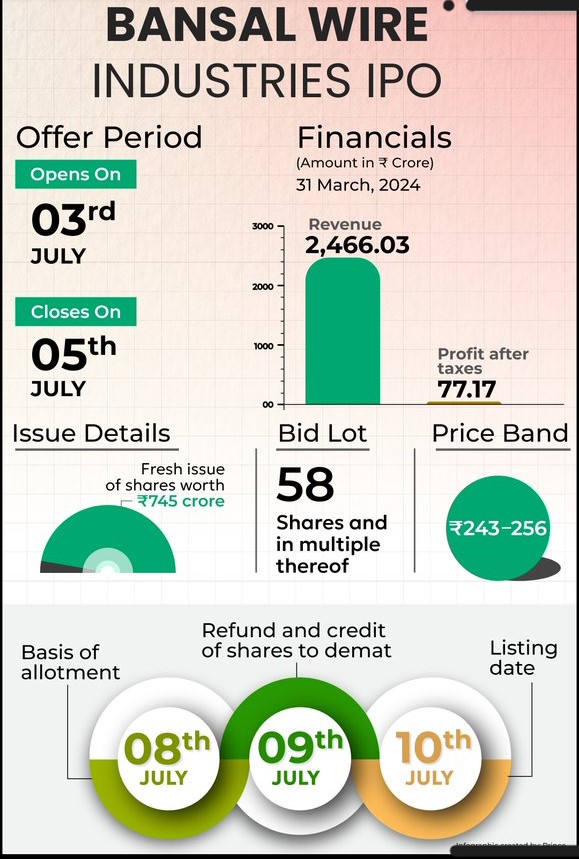

With its initial public offering, top steel wire producer Bansal Wire Industries has entered the IPO market. What prospective investors should know about this opportunity is as follows:

The Basics: Only a new issue of 29.1 million shares make up the Rs 745 crore IPO.

The price range for each share is Rs 243–256.

The period for subscriptions began on July 3 and will end on July 5, 2024.

Strong Retail Interest: Bidding by retail investors exceeded the quota by 0.91 times, indicating their great interest.

Participating non-institutional investors received 0.47 times the amount allotted.

But as of right now, the share reserved for Qualified Institutional Buyers (QIBs) has not been claimed.

Steepen Investors’ Trust:

Bansal Wire successfully secured Rs 223.5 crore from anchor investors one day before to the public issue opening.

SBI Mutual Fund, HDFC Mutual Fund, Kotak Mahindra Mutual Fund, and more well-known brands are among them.

These money will be used by the corporation to cover working capital needs and debt payments.

📢 BANSAL WIRE INDUSTRIES LTD ANCHOR LIST pic.twitter.com/nVVZ72Zi18

— Team IPO Investor Academy (@IPO_ACADEMY) July 2, 2024

capacity for Growth:

Bansal Wire has capacity to grow, with most of its facilities now working at 80% occupancy.

The firm will essentially be debt-free after the IPO, indicating stability in its finances.

Bansal wire ipo #IPOAlert #ipo #NSE #nseindia #investing pic.twitter.com/Eg5O2ORyND

— Vivek Singh (@viveksinghsays) July 3, 2024

Fair Valuation and Listing Gains:

In comparison to its counterparts, analysts think the IPO is reasonably valued.

This offering may appeal to investors seeking listing profits.

Bansal Wire IPO, do you know this information? #ipo #bansalnews #bansalwireipo #sharenews #nifty pic.twitter.com/iJclyCRkdp

— Financial insight-9AM (@Fin_insight_9AM) July 3, 2024

In conclusion, the IPO of Bansal Wire Industries offers a chance to finance a debt-free business with room to develop. Investors should carefully consider their alternatives while the subscription period is still open. 📈🚀